Table of Contents

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- Rate Cut 2024 | Inflation Persists | Comparing Narratives

- Fed Rate Cuts 2024 Predictions Usa - Kali Samara

- Anticipated Fed Rate Cuts 2024 - Rea Leland

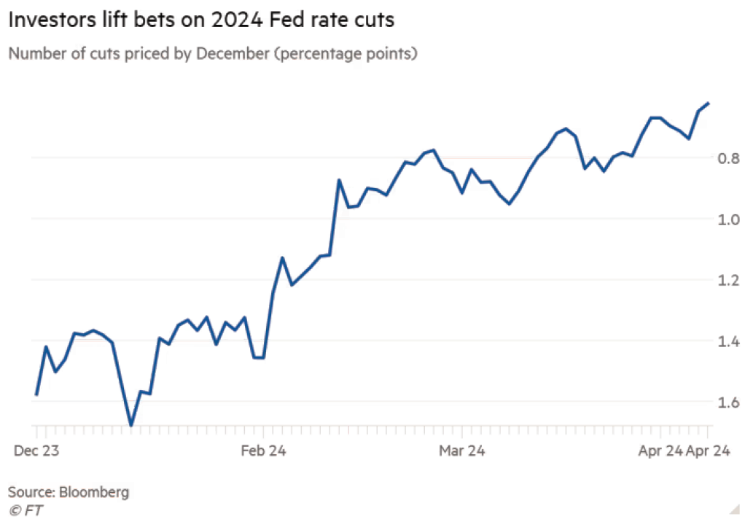

- Traders Trim Bets on 2024 Fed-Rate Cuts After Inflation Report - Bloomberg

- Here's when the Fed might start cutting interest rates | wltx.com

- 2024 Fed rate cuts outlook: '3 or 4 cuts in the back half of next year ...

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- Will 2024 be the year for rate cuts?

- Could the Fed cut interest rates twice in 2024? – AdvisorAnalyst.com

Stock Market Reaction

Bond Market Dynamics

Currency Market Movements

The impact on the currency market is another crucial aspect to consider. A cut in interest rates can lead to a depreciation of the currency because lower interest rates make a country's currency less attractive to foreign investors seeking higher returns. The article's analysis of currency market movements, particularly the performance of the U.S. dollar against other major currencies, provides insight into how global investors are positioning themselves in response to the Fed's decision.

Commodities and the Broader Economic Implications

The reaction of commodity markets, including oil and gold, to the interest-rate cut also offers valuable insights. Commodities can be influenced by expectations of economic growth, inflation, and the value of the dollar. The WSJ's charts on commodity prices post-rate cut can help investors understand the market's outlook on these factors and how they might influence economic activity in the coming months. The Federal Reserve's decision to cut interest rates has far-reaching implications for various markets and the broader economy. By analyzing the reactions of the stock, bond, currency, and commodity markets, as detailed in The Wall Street Journal's "Markets React to Fed Interest-Rate Cut, in Charts," investors and economists can gain a deeper understanding of market sentiments and potential future trends. As the global economy continues to evolve, staying informed about these developments is crucial for making informed investment decisions and navigating the complexities of the financial landscape.For more detailed analysis and to stay up-to-date with the latest market news, visit The Wall Street Journal for comprehensive coverage and expert insights.